- Cost remains a constant conversation for senior management

- COVID-19 has accelerated the focus on cost management (i.e. cost reduction)

- The pandemic has spurred creative ways of working to cope with remote collaboration and increasing volumes of digital information

- Key cost levers include: organisation, productivity, collaboration, technology, and managed services – but there are many more options to explore

- Compliance and risk should not suffer – but there are specific actions that can be taken to reduce the cost of compliance and risk management

- A quick diagnostic can help to frame the art-of-the-possible

Articles

Managing Cost in Equilibrium with Managing Compliance and Risk

By Fergus Allan

May 11, 2021

Solution

Advisory

Compliance

Key points

Introduction

Cost remains high on the C-Suite agenda. Sustained low interest rates, intense competition, impact of Brexit, increasingly commoditized services as a result of market globalization, and recent challenges presented by COVID-19 – all have accelerated conversations about cost. For some, the pandemic has forced creative thinking about costs and efficiencies – and many opportunities have already been unlocked. But for others, much remains to be done to build a more cost-effective business.

Key is to cut bad costs (i.e. waste) and costs not tightly aligned to, or totally necessary for, the delivery of strategic aims. And at the same time, it is vital to not cut too deeply to ensure productivity, quality, and compliance can all be maintained. Morae are experienced in helping clients explore the opportunities to reduce cost, whilst keeping on top of compliance and service effectiveness and quality.

Morae enables digital and legal business transformation for law firms, legal departments, compliance functions, and financial services firms. We help improve our clients’ performance by improving strategy, creating processes, deploying resources, implementing technology and measuring with data. We help clients think creatively about cost optimization opportunities, optimising processes and controls, using our experience to identify common areas to remove cost, supporting transformation of compliance and risk functions, and leveraging technology.

Potential benefits

Aside from the obvious benefit of a leaner and more aligned cost base, the process of examining and considering costs in a structured and thoughtful way has other benefits, including:

- Alignment of functions to the core purpose, as the process of examining costs enables a reflection on priorities.

- Improved customer outcomes, including better customer experiences and service levels, since processes become more effective, adhered to and repeatable.

- More controllable processes, with interventions and controls only applied exactly where necessary.

- More agile risk and compliance management, in which “compliance” becomes a cultural norm, a behaviour, a habit for all.

- Better allocation of resources to key risks.

- Wider acceptance of technology and the possibilities for future technology

- More opportunity to invest “saved costs” into innovation or other developments that will make a firm more competitive.

- Improved platform for both future growth and change.

- Broader acceptance of individual accountability and creating a more empowered and engaged workforce, as opportunities are taken to remove obstacles to those individuals taking on more responsibility.

Morae’s view

In our view, whilst keeping the right balance between cost and compliance, firms can still pursue cost optimisation opportunities in a number of ways. See Figure 1.

Figure 1: Managing Cost: common levers and key themes to explore

Considering the common cost levers

Winning firms look first as the recognised common cost levers. They ask themselves, amongst other questions:

- Do I have the right product and channel mix to deliver on my customer proposition or service in the optimal way? Can I simplify these for better results and lower cost?

- Is my organistional model and structure as effective as it can be? Are my functions tightly aligned to our common goals, or is there friction that introduces unnecessary cost? Can I do more with accountabilities, or spans and layers, to cut costs?

- Do I have the right location strategy? Is my premises spend appropriate? Can I access the skills needed in my core locations, and at the best cost?

- Am I managing my suppliers and other third-parties as effectively as I can? Are the contractual and commercial terms the best I can get? Can I drive efficiencies? Or economies of scale?

- Am I managing change initiatives efficiently? Are my budgets realistic? Will I avoid overruns and overspends? Do I need short-term help to get projects over-the-line, or back on track, saving money in the long-run?

- Can I make (more) use of managed services or outsourcing to reduce costs but maintain or improve quality and service?

These questions, and more, can highlight priority areas to reduce costs.

In addition, there are a number of key themes that winning firms have considered in their cost optimisation approach. These are:

1. Performance of processes and people

Winning firms critically assess key processes, using process analysis to identify and remove waste and help define more efficient, consistent process steps. They make use of technology to translate process maps to Standard Operating Procedures and other process management documentation. This can also help with embedding more consistency and predictability into how work is done. All of this can lead to a lower cost of operations.

These firms will also focus on the productivity of existing teams by focusing on the behaviours and habits that lead to higher performance of teams. They implement better ways of working so that more time is spent on value-add activities, and less on fire-fighting and unnecessary tasks. Their managers manage their teams better, focusing on more effective allocation of work, better prioritisation and resource planning and on driving the rhythm of the teams’ work. Their focus leads to productivity gains, meaning teams can get more work done or generate capacity to pick-up additional high-value work.

Successful firms assess the design of controls, establishing a view about the alignment of controls to key risks and any duplication or overlap that can be addressed to lessen the cost of control. They look at the in-practice operation of controls seeking ways in which control can be improved or maintained at a lower cost – for example, by introducing more effective controls. At all times balancing cost with compliance.

2. Collaboration and alignment

Firms have found that improving collaboration by, amongst other things, making the best use of collaboration tools like MS Teams and other O365 applications or implementing document management systems. This will not only provide better management of documents but also lower costs. In addition, creating intelligent and effective reporting ensures that the right information gets to the decision-makers at the right time, so less time is spent debating the data and more on actioning the insight.

By looking at the types and measure of success in collaboration between compliance and business stakeholders, they are able to seek out and remove any frictions and inefficiencies in the engagement model and the relationship. They can also assess the engagement model, relationship and working practices and identify how they can improve their collaboration, so that both the business and compliance are better enabled to achieve objectives but at a lower overall cost.

3. Managing risk better

Firms have reduced the overall cost of compliance and risk management by deeply considering their approach, covering themes such as prioritisation, resource-allocation, clarity of control performance, reporting and analytics, and the maturity of their compliance and risk culture.

Leading firms set themselves up for success by asking searching questions, such as:

- How can I run my business in the most cost-effective ways, and at the same time meet regulatory requirements?

- How do I control my business without over-complication and with minimal duplication?

- Do we really need to do everything that we do today, or can we do less, or do better?

- Am I getting the right information at the right time, to make the right decisions about risk, about priorities, about allocation of resources?

- Can I trust the First Line of Defence (1LOD) more, once I am certain that they have the capability and will to manage compliance and risks themselves?

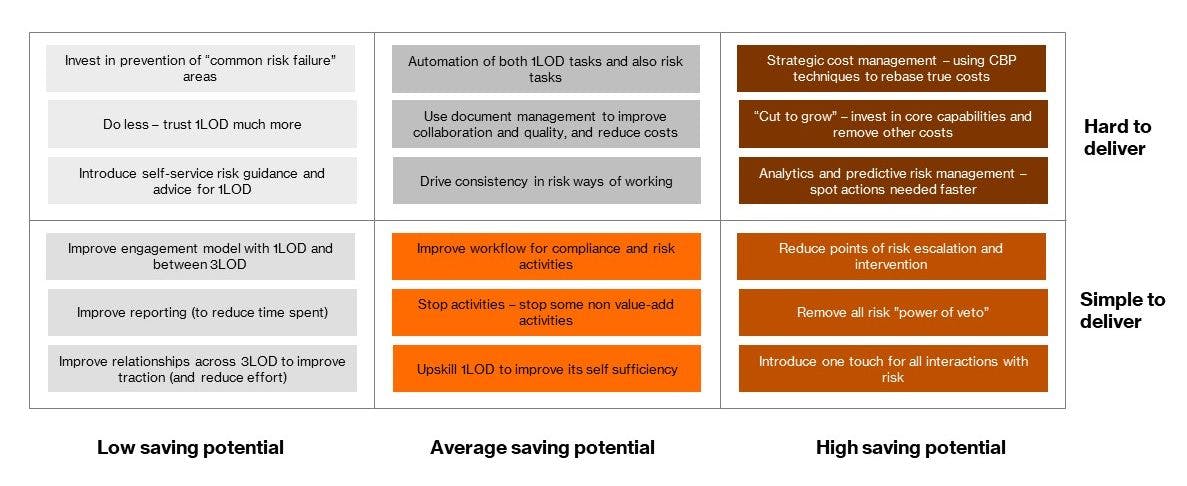

There is no silver-bullet, since risks, risk appetites, and more will vary from firm-to-firm, but there are some common areas where compliance and risk functions can find cost optimisation opportunities. See Figure 2.

Figure 2: Savings potential vs. delivery difficulty

4. Leveraging technology

Clients use technology to reduce costs, exploring the opportunities presented, including:

- RegTech and other GRC systems, that drive efficiencies in compliance operations can supercharge delivery of compliance outcomes.

- Compliance Analytics to better equip compliance teams with information on which to act, and to support fact-based decisions about priorities and investment.

- Automation, either using unattended robots or attended (desk-side support) robots that ensure 100% compliance at scale or support manual work with just-in-time advice and input.

- eDiscovery tools to vastly reduce the manual work required during investigations, or to manage Data Subject Access Requests (DSARs).

- Audio technology to monitor conversations, for example sales conversations, to identify poor compliance, fraud or collusion, or other conduct risks.

5. Strategic cost management

Some clients take a strategic approach to ongoing cost management, using approaches like Commercial Business Planning to examine the true cost of functions, by treating key functions as services and by critically analysing the true cost of delivery. They “ignore” previous budgets and quickly get to the true value delivered by a function and the true cost of that value, building new budgets based on value that are more realistic and accurate in releasing costs as they do.

In some cases, clients have found success with some or all of the above approaches. But a first step is often an open and honest conversation about appetites and outcomes so that wide engagement can be achieved regarding the next best steps.

Morae support clients in starting that conversation. We help clients think creatively about cost optimization opportunities and risk, optimising processes and controls, using our experience to identify common areas to remove cost, supporting transformation of compliance and risk functions, and leveraging technology. Often our clients want a short diagnosis phase to understand the current state of costs and to highlight potential opportunities and the business case for action. We are happy to support that work.

Conclusion

Cost remains a constant conversation for senior management, with COVID-19 accelerating the focus on cost management. The pandemic has led to creative ways to transform how work is done and cope with remote collaboration and increasing volumes of digital information – but even more can be done. There are many cost levers to consider, including organisation, productivity, collaboration, technology, and managed services, among others. A quick diagnostic can help to frame the art-of-the-possible.

Morae enables digital and legal business transformation for law firms, legal departments, compliance functions, and financial services firms. We help improve our clients’ performance by improving strategy, creating processes, deploying resources, implementing technology and measuring with data.

About the Author

Fergus Allan

Managing Director

I am a professional hands-on, problem-solver. I support clients in making brave, sound decisions about how to operate their business more efficiently, how to control their business in smart ways, and how to plan and deliver effective change.